Before applying for a loan, applicants must meet the following eligibility requirements:

- Valid CNIC: The applicant must possess a valid Computerized National Identity Card.

- Age Range: Must be between 18 to 62 years old.

- Business Capability: Should have the ability and intent to initiate or expand a business.

- Clean Legal Record: Must not have been convicted of any criminal offense, regardless of case status.

- Community Standing: Should be of good social and moral character in the local community.

- Guarantor Requirement: Must provide two guarantors who are not immediate family members.

- Location Requirement: Must reside within the operational radius (approx. 5 km) of the Akhuwat branch office.

Documents Required for Loan Application

Applicants must submit the following documents along with the application form:

- Latest Utility Bills

- For the applicant (mandatory)

- For a family member (optional)

- For guarantors (mandatory)

- Recent Passport-Size Photos

- Applicant’s photograph (mandatory)

- Copy of Nikahnama (Marriage Certificate)

- Required for married applicants

- May be waived if not available but verified by other means

Note: Additional documents may be requested based on the specific loan scheme.

Akhuwat Loan Process – Step-by-Step

Akhuwat follows a structured 10-step process to ensure responsible lending and social accountability:

1. Program Introduction

Applicants attend an awareness session at the local mosque or branch to understand the loan process and responsibilities.

2. Application Submission

Candidates submit their loan application form with the required documents at the nearest Akhuwat branch.

3. Social Appraisal

Field officers conduct a social assessment of the applicant’s lifestyle, values, and social credibility in their community.

4. Business Appraisal

A thorough business evaluation is carried out to verify the viability of the proposed or existing business model.

Apply For Loan

Find Nearest Branch to Apply For Loan Click Below to find branch details

5. Second Appraisal

A secondary verification is conducted to cross-check all social and business details before final evaluation.

6. Guarantor Verification

The two guarantors are verified for credibility, willingness, and financial stability to support the applicant.

7. Loan Approval Committee (LAC)

The case is presented before the Loan Approval Committee for a final decision.

8. Loan Disbursement

Once approved, the loan is disbursed in a formal gathering, usually in a mosque, with guidance and ethical commitments.

9. Recovery Deposit

The applicant begins the repayment process through easy, interest-free monthly installments.

10. Monitoring

Akhuwat regularly monitors the borrower’s business and repayment behavior to provide support and ensure transparency.

Objective of Each Step

- Awareness – Educate applicants about the program

- Initiation – Begin the formal application process

- Ethical Screening – Ensure good social and moral character

- Verification – Validate business and social claims

- Guarantor Assurance – Secure the loan with community support

- Approval – Final decision through committee review

- Disbursement – Distribute the loan and offer moral guidance

- Monitoring – Encourage responsible repayment and follow-up

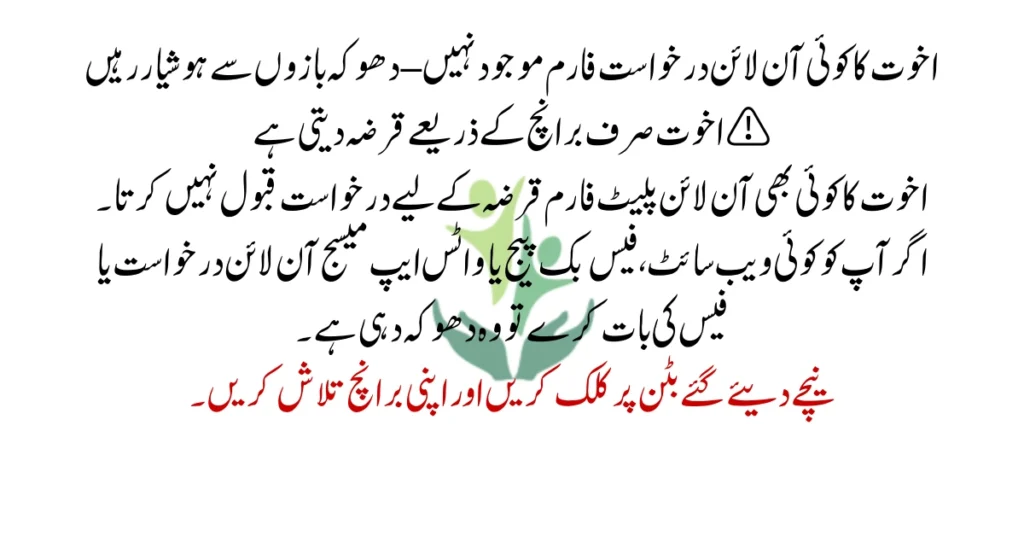

No Online Application for Akhuwat Loans – Beware of Scams!

Akhuwat Does Not Offer Online Loan Applications

There is no official online platform where you can directly apply for an Akhuwat loan. The entire process is conducted in person at designated Akhuwat branches.

Common Scam Tactics

- Fake websites promising instant loans.

- Social media pages demanding “processing fees”.

- Fake forms circulating on WhatsApp or Facebook.

Stay Safe – Follow These Guidelines

- Only trust official Akhuwat websites:

- Never pay any fee online or to a personal account.

- Visit your nearest branch for all application procedures.

- Contact Akhuwat’s helpline for verification before providing personal data.

Akhuwat Operational Locations

Akhuwat delivers services at several local setups for accessibility:

- Mosques

- Branch Offices

- Applicant’s Residence

- Business Locations

This reflects Akhuwat’s community-driven and inclusive approach.